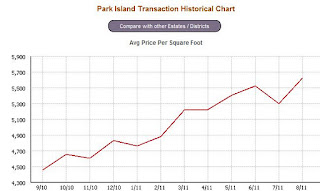

Hong Kong property transactions records - what are the best information sources for current transactions prices?

In the comments section of my blog posting : http://parkislandhongkong.blogspot.com/2011/12/property-prices-on-park-island-hit-new.html a reader commented: "Where did you get this graph chart from? I want to view the source please, I've looked at Midland, Centadata, gohome and property.hk but they show different results to what you have on this blog." Rather than try to anwer the question in the comments section of that posting, I will try to address it here. The data and the HK property transaction graph were taken from Centaline property: www.hk.centadata.com Specifically for Park Island, see: http://hk.centadata.com/pih09/pih09/estate.aspx?type=3&code=WDPPWPPEPB&lang=eng&source=data I think Centadata is based on results done though the Centaline agency, and it seems to me they update the results daily. So you will see changes in the price graph on a daily basis, depending upon the most recent transactions. That is also where I got the price data for...