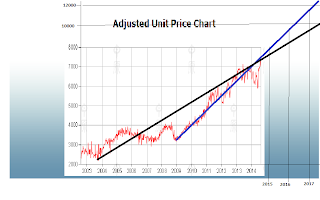

Park Island Property Prices hit fresh highs

Below is the latest Centa City Index price update for Park Island. Park Island Price Graph 2017 Prices now average at $9619.55 psf net, (and over $12500 psf gross). Prices have followed a relatively constant growth trend since 2009. I spoke to an experienced developer's daughter last month who told me that her family believe average prices will hit over 10K psf net by Chinese new year. (By the way, this also makes it very easy to calculate price. For example a 550 net psf average apartment price would be 5.5m HKD). She expected relatively solid growth of 8% per annum over the next 2-3 years, and indicated that she would only be concerned if overall HK prices spiked up something like 20% in a year, which would in turn lead to a further fear of missing out HK-style frenzy (which would in turn eventually lead to a bubble burst). China values social stability and so would ideally like to see contained but constant, non-volatile growth for HK in a way that keeps the majority...