Park Island property prices hit a record high end of August 2015

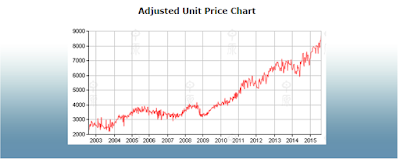

Park Island property prices hit a new record high end of August 2015. Below is the most recent graph: Park Island Property Prices Hit A New High If you look at the end of the graph, you will see a massive 10.86% jump in prices over the last month. Below are the current average prices (gross PSF and net PSF): The data is taken from Centadata HK property price data website (which is the same source I have primarily used in previous updates). For Park Island property owners who have been agonizing over recent stock market losses, take some comfort that at least your property investment continues to rise in value.