Hong Kong property prices - back on the way up in 2019

My last post on the Park Island blog was titled Well that didn't take long. I was referring to the admirable community spirit of Ma Wan residents cleaning up after Hong Kong got hit my massive typhoon, but I could just as well have used that same title for the subject of today's topic, which is about the rapid recovery of the Hong Kong property market.

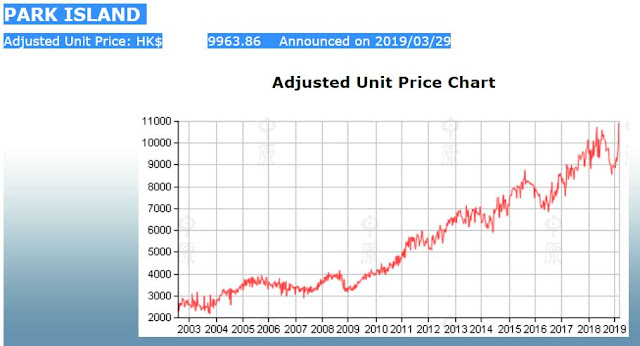

Take a look at the graph of Park Island property prices for 2019:

|

| Park Island Price Graph 2019 |

Look at that massive spike that has taken place over the last few weeks. This price increase has been mirrored across the Hong Kong property market generally, but the upward trend for Park Island has been particularly sharp.

Why?

Well, at a general level, we have the US Fed reducing its outlook for rate rises in 2019. This is positive globally for assets (as assets are usually financed using debt, and if the cost of debt is lower then assets become more "affordable"). In Hong Kong this effect is even more so, as the HKD is pegged to the USD (and hence lower interest rates in the US also flow through directly to Hong Kong).

Further, given a slowdown in China and possible short term effects of the trade war, China has put into place a range of stimulative measures to support the economy. And a decent chunk of that stimulus makes its way into Hong Kong property (whether intended or not) as wealthy Chinese get access to money and try to take it off-shore.

With regard to Park Island specifically, the estate is an existing and fully sold development (not an off the plan estate which requires 100's of sales to sell out) and is also fully tenanted. Only a small number of apartments come onto the market at any time. And given the comparative affordability, any sign of a market recovery will lead to buyers (both investors and end-users) very quickly coming in and making offers, especially given the ease of getting bank loans for these types of apartments.

It will be interesting to see how things pan out this year, but so far it seems the long term trend of apartment prices I indicated in my post here remains intact.

Wishing all residents of our beautiful estate a wonderful weekend. In a future article I will comment on the role and effect of the Greater Bay Area Initiative may have on Ma Wan and demand for property (and consequent implications for prices).

PS - a little birdie tells me that we will soon see a couple of record transactions taking place in Anacapri (phase 6).

Where is this maddness going to end! Prices seem to have lost all ability to be pulled down no matter what.

ReplyDeleteIts the price range of 8m that will see the biggest jumps. For the larger places wait until the stamp duty is normalized.

ReplyDeleteYes, I am inclined to agree entirely. For larger apartments, I would just sit and hold. They will become increasing rarer in terms of % of total supply, and so it follows that price PSF for larger apartments will go up faster than smaller apartments which are in more abundant supply.

DeleteI have no doubt that prices in HK will hit a new peak at end of 2019.

ReplyDelete